Copper prices have soared due to soaring demand for electric vehicles.

◆ Copper price is the highest in 10 years, surpassing $10,700 per ton as of May 11th 2011.

SUS for tonne

No Data Found

- As the economic downturn caused by the spread of coronavirus infection (COVID-19) shows signs of recovery, the price report of copper is renewed

- Goldman Sachs Expects Copper Prices to Surge... LME copper futures price target of $11,000 per tonne in 2023

- Copper inventories expected to run out as demand recovers following China's reopening

- The surge in copper prices is related to demand for new eco-friendly industries such as electric vehicles and wind power, and it is difficult to develop new large-scale mines since

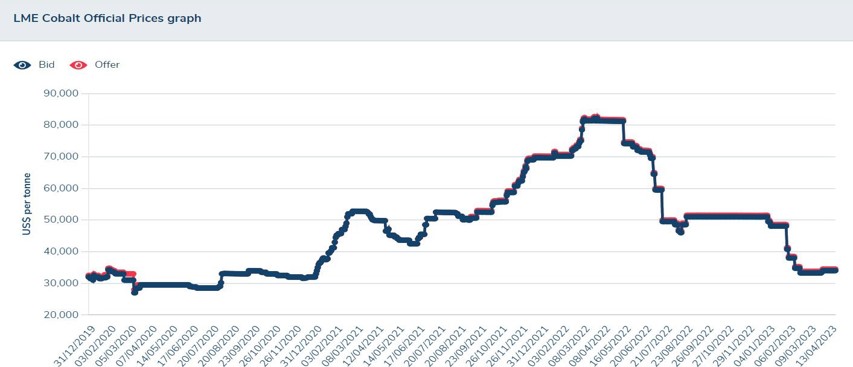

Fluctuating price of cobalt and lithium... "Securing raw materials for batteries" war.

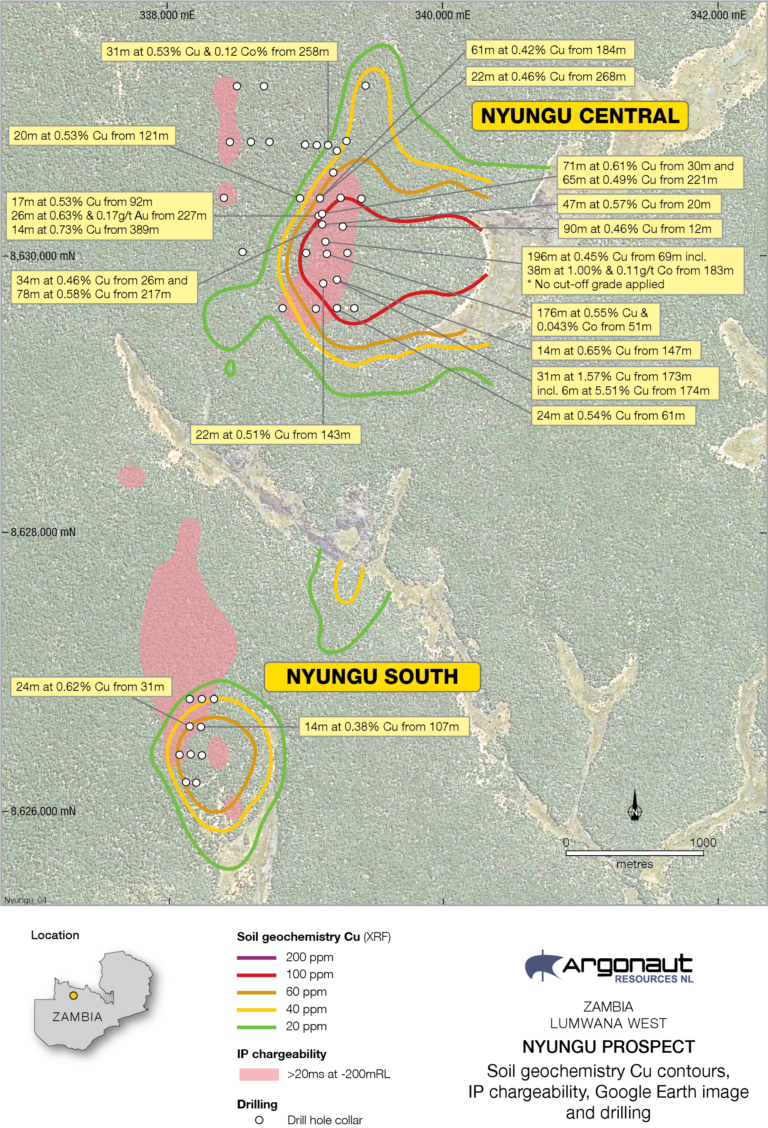

Surrounding Targets

NYUNGU Copper-Cobalt

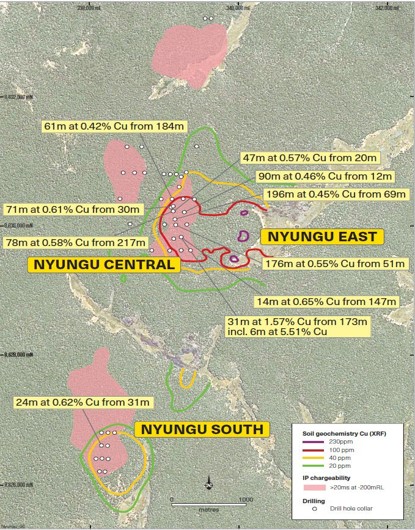

As a result of Soil anamaly analysis, additional reserves are expected to be checked at NYUNGU East.

-

NYUNGU CENTRAL

The Nyungu deposit is confirmed by 50+ drill holes. Mineralized copper deposit with strong potential for extensions. Demonstrated strike length: 1,700m and is open to the north and south

-

NYUNGU East

recently defined an intense copper anomaly at Nyungu East. The Nyungu East copper anomaly is higher in intensity than the Nyungu Central soil anomaly.

-

NYUNGU SOUTH

The Nyungu South deposit sits in a location where a copper soil anomaly and an IP geophysical anomaly (i.e. a zone that may contain disseminated sulphide minerals) are coincident. The IP anomaly continues northwards from the soil anomaly over a significant area.

Deal Proposal

Requested Amount of stock purchase from existing shareholders : 100 million US $

Shareholding Ratio for Investment: 55%

nAcquisition cost of additional shares

Up to 30% of additional shares can be acquired depending on the results of the exploration (up to 85%)

The amount of additional equity acquisition is determined by the evaluation and negotiation of an external evaluation agency (prior right to purchase)